Self-Directed Retirement Plans

Discover The Plan That Is Right For You

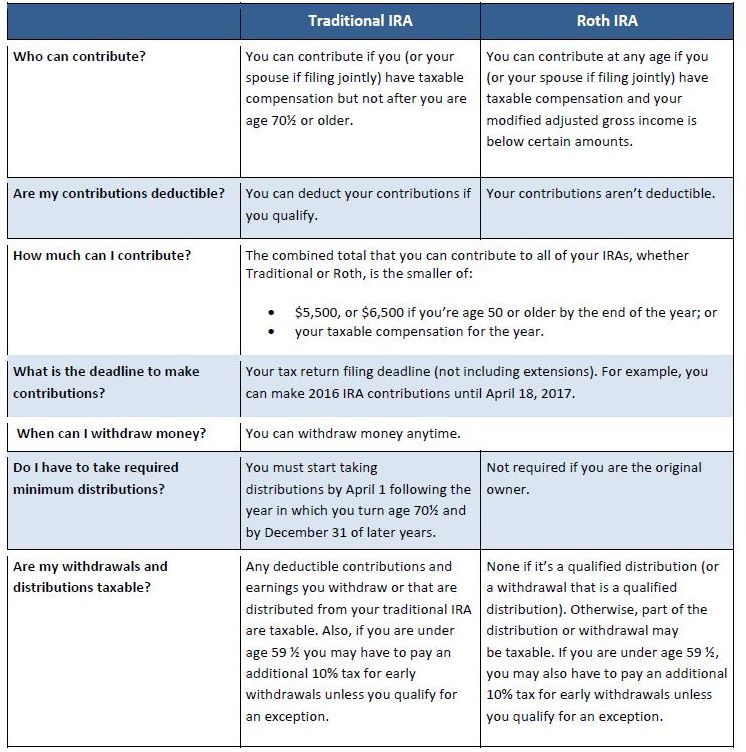

Traditiona IRA vs. Roth IRA

Traditional IRAs and Roth IRAs are both great investment vehicles and provide wonderful tax advantages. The question is often asked: Which is better? The answer is: It depends. Both plans allow you to strategically plan and save for retirement; however, a Traditional IRA might not be the best plan for everyone, and a Roth IRA might not be the best plan for everyone. If you are in a high tax bracket now, and expect to be in a lower tax bracket in the future a Traditional IRA might be best. If you are in a low tax bracket now, and expect to be in a high tax bracket in the future a Roth IRA might be best. If used properly, the IRA type that you choose will help you save and best adjust your tax liability to a time in your life that makes the most sense. Traditional IRAs are tax-deferred vehicles. This means that the money is taxed as you pull it out of your plan. Roth IRAs are post-tax retirement vehicles. This means the contributions made to the Roth IRA have already been taxed and that qualified distributions from the plan are tax-free. It is also important to understand that income limits determine the deductibility of contributions in a Traditional IRA and eligibility of contributions to a Roth IRA.

Traditional IRA Vs. Roth IRA Comparison Chart